Smart, Secure, and Globally Connected

AYBANK cards are built for the way you live and work today Experience financial freedom with AYBANK’s virtual and physical cards — designed to make global spending effortless. Shop, travel, and transact in multiple currencies with real-time conversion, AI-driven insights, and advanced protection for every purchase. Whether you’re managing personal finances or company expenses, AYBANK gives you the control, clarity, and confidence to spend smarter..

Global Acceptance

Use your AYBANK card anywhere in the world with instant currency conversion and transparent fees.

Virtual & Physical Cards

Get instant access to virtual cards for online use or request premium physical cards for global spending.

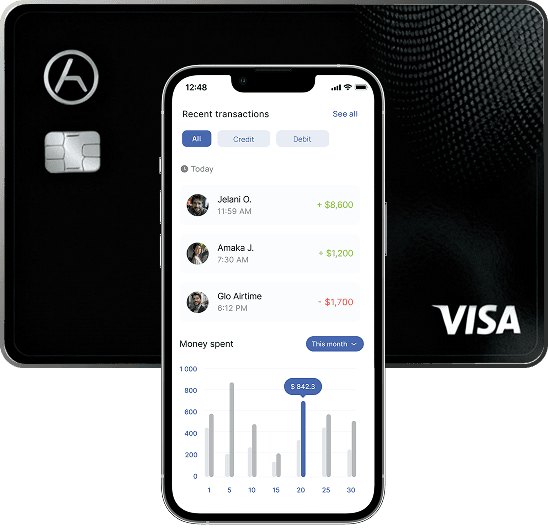

Spending Insights

Receive intelligent updates that help you budget and track smarter.

Global Protection

Every payment is safeguarded by advanced fraud detection and encryption.

Fast. Secure. Effortless. Shop Worldwide, Pay Privately.

AYBANK provides instant, seamless payments across a broad network of online merchants.

Streamline Your Finances with AYBANK

Easily track, manage, and analyze your company's expenses, ensuring complete control over your financial operations.

Invite. Earn. Repeat.

Turn your network into rewards with AYBANK’s Referral Program. Invite friends and colleagues to join, and earn instant bonuses for every successful sign-up. Simple, seamless, and built to maximize your earning potential.

Enterprise-grade security & intelligence

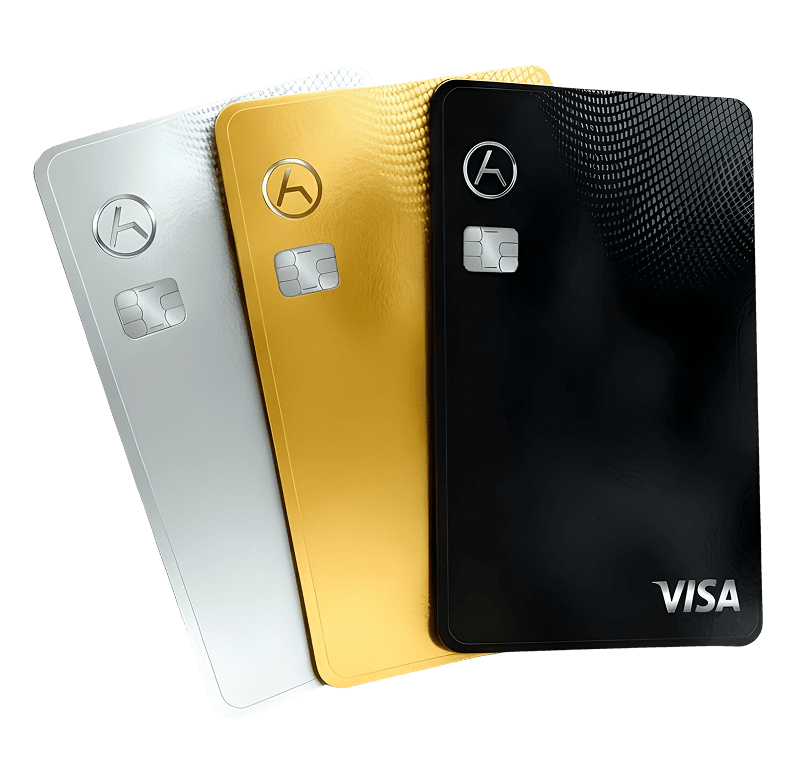

Smart Payment Cards

Experience seamless spending with AYBANK Cards — designed for convenience, flexibility, and global acceptance. Make purchases securely online or in-store, anywhere you go.

Virtual & Physical Cards

Get instant access to virtual cards for online transactions or request physical cards for everyday use. Manage all your cards easily within the AYBANK app.

Advanced Security & Control

Stay in control of your finances with real-time spending alerts, instant card locking, and intelligent fraud protection powered by AYBANK’s secure infrastructure.

card questions answered

Explore everything you need to know about using your physical or virtual card for purchases, transfers, and account management.

A payment card lets you make purchases or withdraw cash from a balance that’s been preloaded onto it. You can only spend what’s available, and once the balance runs out, you’ll need to top it up before using it again.

Virtual cards exist digitally and are mainly used for online or mobile payments. They come with enhanced security and don’t have a physical form. Physical cards, however, are tangible and can be used at ATMs or for in-person purchases.

Absolutely! You can link both a physical and virtual card to the same account. The virtual card is great for online use, while the physical one can be used in stores or at ATMs—all from the same balance.

No, virtual cards are made for online and mobile use only. You’ll need to use your physical card for cash withdrawals at ATMs.

Yes, you can. Physical cards include all the required details—like card number, expiration date, and CVV—so you can use them for both in-store and online purchases, as long as you have available funds.

Yes! Virtual cards can handle recurring payments such as monthly subscriptions, memberships, or other scheduled online transactions with ease.

They are! Both virtual and physical cards can be used for business-related expenses. Many companies issue cards to employees or departments to manage subscriptions or control spending limits.

Yes, once your virtual card is activated for international use, you can shop and make payments in multiple currencies worldwide.

Definitely. You can set spending limits on your virtual or physical card, making it easier to manage your budget or business expenses.

Yes, you can move money between your linked accounts or send it to another account, both domestically and internationally, depending on your card provider’s options.

Discover The AYBANK Online Portal

Take a guided tour and explore how to manage accounts, payments, cards, and more.